NFT-BLOCKCHAIN : IMPLICATIONS FOR PHYGITAL

By Alveena Bakhshi, Storied Digital and Product Transformation, Veritux

Non-Fungible Tokens (NFTs), although a mere token on the Blockchain, are a significant opportunity such that the technology and market infrastructure is filling out and an NFT-Blockchain is no longer a thing of the future.

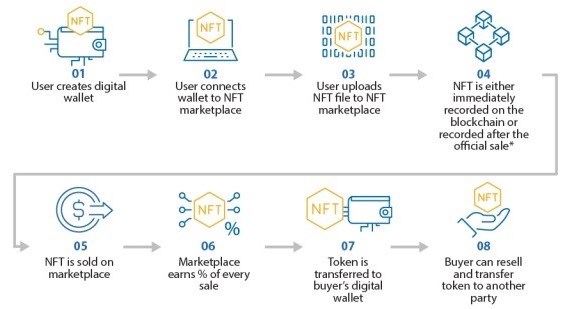

Decentralization, unique digital ownership, and immutability are core to NFTs. They are minted on public, permissionless blockchains therefore, any node on the blockchain can read and submit transactions. A smart contract adds the NFT to the blockchain via metadata, and can also be accessed using a searchable blockchain explorer. Some NFTs are recorded on the blockchain after the sale on a marketplace. The owner of the NFT in the blockchain metadata has the right to transfer the token to someone else. And while a token may signify ownership of the underlying phygital item, the token doesn’t need to represent the legal ownership or grant legal copyright to the item. These may be conveyed via a reference in the metadata to external terms and conditions or contracts.

NFT smart contracts include industry standard codes and commands, allowing interoperability between wallets, marketplaces, and other platforms. Marketplaces help manage contracts and back-end coding on blockchains. Assets underlying NFTs rely on off-chain storage such as centralized servers, Arweave, and Amazon Web Services, which is comparably inexpensive and efficient compared to blockchain storage. The items are viewable in digital wallets through APIs whereby wallets, with varying levels of security, store cryptographic public and private keys corresponding to NFTs, and cryptocurrencies, and communicate with a blockchain.

The marketplace is a web-based platform for the exchange of NFTs for a fixed price or an auction. It mostly accepts cryptocurrencies such as Ether on Ethereum but also accepts fiat currency.

The most popular blockchain for NFTs is Ethereum. It hosts the OpenSea marketplace and projects like CryptoPunks and Bored Ape Yacht Club. Despite the costly Proof-of-Work (PoW) consensus mechanism, decentralization, and ease of use make it popular. Even though Solana’s combination of Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus mechanisms makes it one of the fastest programmable blockchains with very low transaction fees and times, it is not as widely used. Tezos offers a green alternative costing two million times less energy than Ethereum, using only a PoS mechanism and hosting to Objkt marketplace. In contrast, Flow is specific to creating NFTs, using PoS with scalability in mind. In addition to its own Blocktobay marketplace, it offers tradability on OpenSea, Rarible and Foundation and other platforms. NBA, NFL, UFC, and more have launched their own marketplaces on Flow. Worldwide Asset Exchange (WAX) for digital collectibles and memorabilia, and Binance Smart Chain (BSC), a centralized option connected to the Binance Crypto Exchange, have also been gaining popularity.

The marketplace is a web-based platform for the exchange of NFTs for a fixed price or an auction. It mostly accepts cryptocurrencies such as Ether on Ethereum but also accepts fiat currency. Participants may sell or trade without intermediaries. While operators pay royalties to creators upon a sale, a fee compensates for verification of transactions recorded on the blockchain, such as minting, selling, or re-selling an NFT. For NFTs recorded on the blockchain after their sale, fees may be exempt or paid for by the buyer. Referred to as the gas-fee on Ethereum, a gas-war may ensue when participants are willing to pay more to cut down transaction time. Complex transactions such as deploying smart contracts also cost more, as do fees during high network traffic.

OpenSea is the largest NFT marketplace with a market valuation of $13 billion, followed by LooksRare at about $7Bn. Recently Solana’s Magic Eden was valued at $1.6Bn. According to Jefferies, the market is highly concentrated and stratified at $14Bn and is expected to grow to $75Bn by 2025. About three-fourths of NFTs sell for less than $20 and a third is a no-show. Market sizing poses a challenge as illicit practices such as “wash trades” drive up valuation. However, as NFTs find wider applications as digital representations of deeds to a house or title to a car; enabling digital identities, granting exclusive access to events and services, NFTs have the potential to become an integral component of Web3 and the metaverse. In Web3 decentralized architecture built on blockchain technologies, NFTs may be central to tokenization because they represent unique ownership, an advanced form of digital identity in the metaverse for branding and trading.

As for the NFT Technology Policy Imperatives, take for instance, Privacy and Content Moderation, whereby smart-contract code is visible to all blockchain participants, which includes bad-actors. Further, the code may not be easily changed, hence were assets stolen, they may not be recovered. Ethereum estimates such losses to be easily over $1B. International groups have used NFTs to avoid government censorship of online information. The Energy and Environmental cost of NFTs minted on the more prevalent PoW consensus protocol for blockchain, requiring very high computation power and security of the network, is also prohibitive. As there is no single agency with authority over digital assets, depending on the role the asset and/or the market players play, NFTs may be treated differently by various Financial Regulators; as a virtual asset service providers by Financial Actions Task Force (FATF), and as persons transferring virtual assets Anti-Money Laundering / Combating Financial Terrorism (AML/CFT).