TOKENIZATION AND THE CRYPTO-CARBON BUBBLE

By Alveena Bakhshi, Storied Digital and Product Transformation, Veritux

The first climate token was announced five years ago in 2017, not too long ago if you consider half of those five years were engulfed in a pandemic. But with the renewed focus on climate action and net-zero targets, these years have seen the launch of several climate blockchains, cryptocurrencies and tokenization projects. The $607 million global market for carbon offsets is expected to grow at a CAGR of 31.2%, to $4.27 billion by 2028. On the other hand, SWIFT, the global payments protocol, announced its solutions for CBDCs (Central Bank Digital Currency) and asserted that all digital assets would eventually only be traded and settled on digital ledger technologies. The volume of assets being tokenized is expected to reach $24 trillion by 2027.

The convergence of the digital assets and carbon offsets markets, although an opportunity to bridge the significant gap in climate finance, has made climate experts shudder. While blockchain has helped sequester and monetize climate assets, take KlimaDAO and MOSS Amazon NFT for instance; the former raised 17 million tons of on-chain carbon offsets between its launch in October 2021 and March 2022, it raised only 400,000 tons of offsets since, as Verra, the carbon credits standards organization hit reset on the accreditation, due to subprime fears. As Reuters’ investigated MOSS and shed light on the dark side of crypto-carbons, Verra leaned back, into the banks-led Carbonplace, to expand the carbon-credits market.

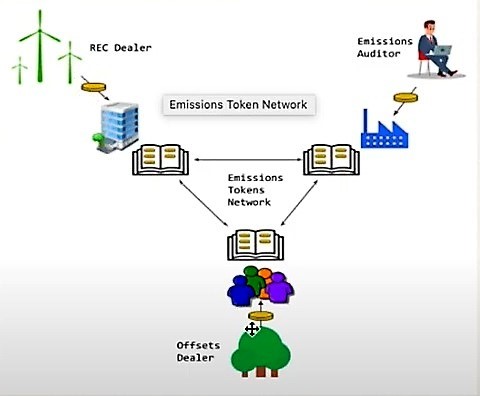

The Hyperledger Foundation has been developing carbon emissions token on eThaler, a Central Bank Digital Currency, on a private Ethereum network running Hyperledger Besu. The token follows the Carbon Emissions token taxonomy by the Interwork Alliance and uses eThaler smart contracts for verification and enforcement. Its Emissions Token Network of Renewable Energy Certificate and Offset dealers, and Emissions Auditors, figure 1, issues tokens to individuals, companies or buildings, all of which can be traded or retired from emission-wallets, except those issued by auditors. Separately banks, including, CIBC, SMBC, BBVA, and BNP Paribas, also plan to launch the Carbonplace blockchain/marketplace, backed by Verra carbon-credits.

Since the 90s the carbon market has mainly been voluntary therefore overall lack of standardization, quality of environmental projects, collaboration, inter-operability, transparency and climate finance, are far more relevant concerns plaguing the market. The initial alarm raised by CO2 emission of blockchains have led to sustainable blockchain design ; multiple use versatility, decentralized network, diversifying away from Proof of Work protocols; and policies to regulate mining and energy usage including direct taxes are on the table. Solarcoin, Powerledger, Cardano, Devvio, Algorand, Tezos, Gridcoin, EFFORCE, GreenTrust, and Near Protocol are the top sustainable crypto-currencies or platforms, of particular relevance in the climate sector today.

ClimateCoin, of the first peer to peer decentralized platform for carbon credits trading/exchange in the world, now on Algorand, converts carbon credits into NFTs, as a bridge between off-chain registry and on-chain digitized carbon credits. NFTs are locked in carbon pools of (1) mitigation / reduction (2) removal (3) renewal, and converted into fungible Algorand standard assets. A percentage of every ClimateCoin financial transaction is distributed to the original creators of the carbon credits. REGEN is a stalking and utility token powering an application specific blockchain for ReFi (Regenerative Finance). It is available on the Osmosis and Gravity decentralized exchanges and token-holders may participate in their respective pools for liquidity.

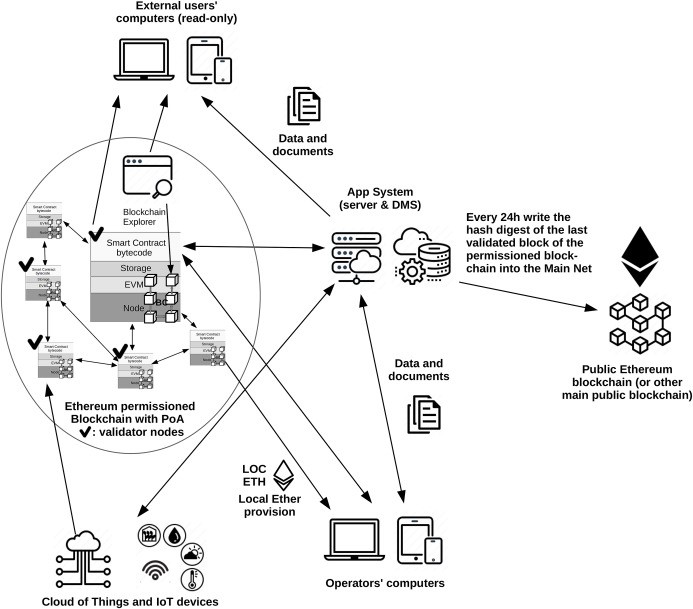

A decentralized application in blockchain, or dApp, cited above, can also verify and enforce carbon offsets with the same level of trust and transparency as the public blockchain it is anchored to, at much better price, performance and energy consumption. dApp not only democratizes the blockchain but also helps increase the supply of high-quality carbon credits by guaranteeing provenance. Figure 2 is an indicative architecture of a dApp equivalent of PoA whereby Validators manage the nodes; Participants receive, validate and broadcast transactions but do not participate in the consensus mechanism; Operators only send transactions changing the blockchain state; and External users may access the system nodes in read-only mode.

Image Source: Science Direct

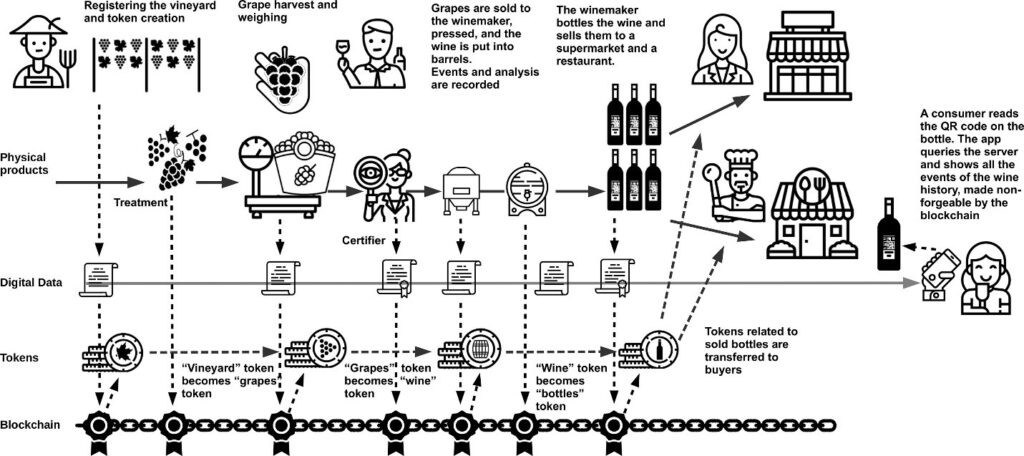

In a dApp system approach to wine-making, for example, the growing process is a small factor in total greenhouse gas emissions, but where the grower is constantly incorporating climate feedback to combat climate change to produce wines. Transportation, bottling and waste cause 80% of total emissions across the industry and have been driving changes in form-factor. Consumers can impact climate change by buying from local and/or sustainable wineries. In figure 3, the first technology layer is physical entities, second is digital data, such as certification, and pictures which can be stored off-chain. In the third layer are tokens tracking physical products. Finally, with registration on a blockchain, the provenance is made non-forgeable.

Image Source: Science Direct

The Impact App, developed by Eco Labs with Regen Network open-source methods registry, ReFi DAO, Coffee & Carbon Collective, dMeter, ReFi Zone, Return Protocol, Common Action, reduce friction in on-boarding projects, which can expand the supply of high-quality carbon credits. And the app is a complement to ReFi and dMRV (digital Measurement Reporting Verification). ClimateTrade uses dMRV for the traceability of carbon neutral projects, sustainable projects and guarantees-of-origin scope-2 projects. Gold Standard dMRV retires high impact carbon credits in real time and issues certificates. Nori converts such certificates into tokens. dApps may corral Vlinder Climate, Sea Trees, and H2ON, for example, to participate in Blue Carbon ecosystems.

For a token to have value, it needs to be an incentive to use or hold it. Easy Energy Climate Token, issued to drive the use of energy-saving modular systems and managed by a registered broker-dealer and FINRA/SPIC member, and Nature’s Vault Legacy Token, backed by 10 grams of in-ground gold controlled through Mining Rights are incentive-based tokens somewhat lacking in the market. But it is not for want of technology or incentives that crypto-carbons are not meeting with success. Crypto-carbons are attempting to meet both the store-of-value and utility function in the same token. Creating two tokens, separating the financial and the utility incentives, possible on the same blockchain, may be a climate tokenization model all can embrace.